Introduction About Finance Decision Maker

Financial analysis is playing a vital role in the management decision making process. All the decision that is taken by the three levels of the management is on the basis of the financial performance of the company. The financial performance of the company is responsible for the determining the position of the company in the market. As the senior management of the company is involved in the critical decision making and these decision decides the future of the company in the market (Khatta, 2008). Depending on the internal and the external factors the management initiate for the new project. Project management is the major task for the company as this brings revenue for the company. Therefore the managers at the senior position need to have the crisp knowledge of the financial aspects so that the decision can be taken effectively and efficiently. The major objective of the report is to determine the importance of the finance during the business decision making assignment process and especially considering the project management aspects.

“Why advanced finance for decision makers is a vital addition to professionals, and particularly project management, at a senior management level.”

The relationship between financial analysis and business risk assessment in decision-making

Determining the factors that guide and drive decision-making in business

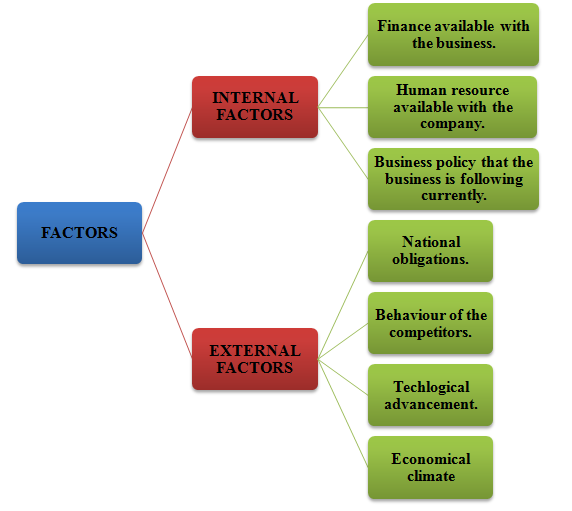

As per the requirement of the business, there are some of the factors that are help in successful decision making process of the business. The factors are divided in to internal and the external factors (Aven and Vinnem, 2007). The diagram shows the factors that are internal and the factors that are external in nature.

Figure 1: Factors influencing decisions

Assess the significance of financial factors in business decision-making

It is the responsibility of the senior management level to consider these factors while deciding and critical issues. The major among them is the financial factor that is the management of the finance or the availability of funds with the business. For the establishment of the any proposal or at the initial level of the project, it is necessary that the company should check the finance available s the finance is the life blood of every business (Chew, 2013). Once the arrangement of the finance assignment is done properly, the other needs of the project can be arranged easily. With the help of arrangement of the finance the business is able to plan the blue prints of the actions that will be preceded (Average rate of return Homework help and tutoring. 2011).

Identify the characteristics of business risks that impact on financial and business decisions.

Risk is the major factor that the business has to control at the initial stage. It is basically the uncertainties that arise regarding the generation of the profits due to some of the factors. The business risk is of the two types that the senior management has to take care of (Understanding Fianancial Ratios. 2013). The internal risk arises due to the factors such as human resource factor, technological factor along with physical factors and operational factors (Shapira, 2002). These are the factors that the management has to control and manage at priority as they are controllable in nature. The external risks are those that are not under the control of the business. The factors that are related to this form of risk are economic factors and political factors. Natural factor is also categorized under this category of risk. It is the whole and sole responsibility of the upper level management to take the effective and efficient measures for controlling both the external and the internal risks (Chew, 2013).The business can suffer from a great loss due to the mismanagement of these risk or the failure of the technique applied for the controlling risk (Modigliani-Miller Preposition I Theory. 2011).

The purpose and structure of financial statements in relation to decision making

Explain the structure and content of final accounts and their uses for business decision-making.

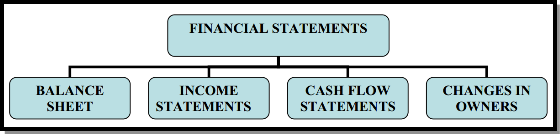

The financial statements of the company are the reflection of the financial position of the company in the market. Therefore to determine the performance of the company, the financial statements are the major priority for the stakeholders of the company (Flynn, Uliana and Wormald, 2012). The business decision making is depended on the financial data of the company as the transaction of the funds in the company can be judged on the basis of this statements only. The format of the financial statement is the one of the major necessity as it makes the work of the upper level management to categories the funds and analyzes them properly. Therefore the company follows a proper structure of the financial statements (Advantages and limitations of Ratio Analysis. 2013). The major financial statements are given below:

Figure 2: Financial statements

For analyzing the strengths and weakness of the company can be determined to some extent from the financial data. The senior management can keep these issues and facts in mind while deciding on the specific problems of the company (Stoltz, 2007).

The financial data that is available in the balance sheet is necessary for the determining the actual assets and the liabilities of the company. The calculation of various ratios for the financial analysis depends on the balance sheet of the company. As per as the income statement of the company is concern, it determine the actual income that the company has earned against the expenses that are done for proposing this earning (McMenamin, 2002). With the help of the data provided by the income statement the company is able to determine the profit that can be used for the proposed future projects. With the help of the cash flow statements the company is able to determine the cash inflow and the cash outflow which is essential element at the time of decision making.

Determine financial ratios from final accounts that can be used to support business decision-making

There are some of the ratios that are equally important for the decision maker to keep in mind while analyzing or deciding. Some of them are as follows:

- Liquidity ratio: It is used for the determining how much the company is sound financially regarding the payback of all the short term liabilities remaining with the company.

- Activity ratio: It is useful to analyze the level of the resources available with the company.

- Economy ratio: The revenue and the expenditure are the major elements for the company and this ratio is helpful for determining the relation among the revenue earned by the company and the expenses done by the firm (Correia, 2012).

- Leverage ratio: The level to which the company is able to manage the creditors is known with the help of this ratio.

- Profitability ratio: This ratio is essential for the company as this helps to determine the return that the company is going to earn in respect of the capital earned. The management of the efficiency is also done with the help of this ratio.

- Invisibility ratio: This ratio is helpful for analyzing that whether the investment in the ordinary shares of the company is profitable or not.

Therefore it is essential for the decision maker to check these ratios of the company and then to decide among the alternative available with the company (Foundations of business decision making: BUS 101 - Miami University. 2008).

Sources of finance for short and long term business decisions

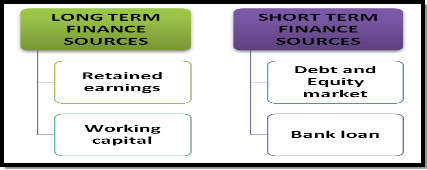

The major sources of finance that is available for the business are given as under:

Figure 3: Sources of finance

The company has to manage these sources of finance before moving forward for any of the financial decisions making. As per the nature of the requirement the sources varies. Now it up to the senior management to decide the best sources that can provide finance at low interest rate and quickly (Barnes, 2006).

Differentiate between long-term financing needs and working capital needs for businesses

There are some of the funds that are required for the business for the short duration of the time whereas some funds are required for the continuing the regular and day today activities of the company. The management of these funds in the major task for the company because there the balance of the long term and the short term leads the company to success. The company should be capable enough to differentiate the expenses in to the major categorization. The long term financial is the necessary for the controlling the financial needs for the huge project that the company continues for the more than five years (Litzenberger and Jones, 2012). For the management of the long term financial needs the company generally uses the sources such as share capital of the arrangement of the loans from the bank. In case of the arrangement of the short term finance for the company the company can adopt bank loan along with which the company will be able to utilize the current account facility.

Compare the sources of long-term financing and working capital financing for businesses

The sources of the long term financing are very different as compared to the working capital. The need of the working capital is more essential than the fulfillment of the long term finance. To some extent it is unethical to compare this financing requirement because both of them are having their own credentialed and importance (Quinn, 2005). These arrangement sources are very different for both the financial requirement. Along with the long term financing is done for the development purpose of the business whereas the working capital is used for the fulfilling the day today activities.

Identify why access to working capital is critical to business continuity

At the time of the continuous processing of the business activity the company is not able to analyze that how much of the operational funds are required. As soon as the time passes the requirement of the working capital increases (Masood, Aktan and Chaudhary, 2009). The company has to manage the working capital at the priority as the whole operation of the company depends on the working capital to some extent. As this fund is depended on the situation of the market, so it is critical and difficult to access the working capital exactly.

Assignment Prime is an online assignment writing service provider which caters the academic need of students.

Get Best Pricing Quotes Free Samples Email : help@assignmentprime.com Order NowWays in which different ownership structures influence the measurement of financial performance

The ownership structure is termed as the division of equity in consideration to capital and votes but also by the individuality of equity owners. The structure is of vital importance in corporate governance because they conclude the incentives of managers and the economic efficiency of the corporation’s (Baum and Wally, 2003). Return on capital employed plays a very vital role in all of the ownership structure, it measures the returns that a business is realizing from the capital employed and indicates the efficiency and profitability of business’s capital investments.

There are different types of ownership structure which influence the measurement of financial performance; sole proprietorship are the most ordinary and widely used form, of the business, they are build by persons who hold all the property and assets of the business. They are individually responsible for all the financial control and management of the business and usually financial statements are of less importance for the sole proprietor because they bear all the risks and profits of the business and are personally liable for all the financial operations of the business (Barbaro and Bagajewicz, 2004).Partnership is a multiple owner business and partners manage the business and share fully in its profits and losses, they measure the financial performance by analyzing the accounting ratios of the business like liquidity ratio, turnover ratio and profitability ratio etc. Partnership requires an efficient ownership structure; all the partners must be financially capable or sound of holding the share in the business.

Company is more complex and composite business structure, as a separate legal entity company has certain rights, liabilities and privileges beyond certain beyond the limits of individual. A company measures its financial performance by analyzing its financial statements which includes income statements, balance sheet and cash flow statement. These statements reflects the company’s total assets, liabilities, sales, profits, expenses, cash outflow or inflow etc, all these factors helps in analyzing the financial steadiness and sustainability of the ownership structure of the company. An effective ownership structure in the company can lead to progress and growth of the business. Earnings per share (EPS) are the portion of the company’s distributed profit which is distributed to each outstanding equity share; it is a good pointer of measuring the financial performance of the company.

The place of ethical, governance and accounting standards in financial reporting and business decision-making

“Ethics is detrimental to success in business”, business ethics are the structural and critical evaluation of behavior of people and organizations in the business world; they are the guiding principles behind the working of the enterprises and it’s about recognizing what is right and what is wrong under the business environment.Use of ethics in financial reporting is important; reporting should be done in exact and accurate manner (Barnes, 2006). Governance is a framework defining issues relating to strategy, processes, technology and people, an effective government policy identifies a governance framework and an incorporated reporting system. Corporate governance deals with the principles of accountability, responsibility, integrity, mutual respect, honesty and commitment in the business. The primary purpose of accounting standards is the improvement and harmonization of financial reporting, in recent years accounting standards has been involved in a number of other activities such as joint venture with national standard setting bodies.It is concerned with setting standards for all the companies and organization that prepare accounts that are expected to project true and fair values. Accounting standards exists to ensure that accounting decisions are made in an integrated and sensible way (Barnes, 2006).

Accountant plays a major role in financial reporting of the organization, he is responsible for the accounting of the company to truly represent what is going on in its financial arena, and its bookkeeping numbers must be honest and accurate. Honesty and accuracy in accounting are ethical as well as financial issues. Accountant has the accountability and answerability of representing information in ways that authentically signify the functioning of the business. There are certain requirements for published accounts of public limited company such as incorporation procedures, articles of association, registration, fees, public notice, capital structure, liquidation, books and records and audit. All these elements are necessary for the functioning of the PLC (Barnes, 2006). The main objective of international financial reporting standards is to develop a single set of high quality, enforceable, understandable and worldwide accepted financial reporting standards through its standard setting body and to take account of financial performance of emerging economies and small & medium size firms (Risk Management. 2013.). Hence it can be concluded that ethics, corporate governance and accounting standards all are of vital importance in the financial reporting and business decision making. Ethics and accounting standards sets the legal framework for all the public and private ltd. companies and also frames the legal policies and provisions which are to be necessarily followed by the firms.

Task 2:

As per the requirement of the company there are some of the financial prospects which need to be kept in consideration while deciding among the proposal available for the company. On the technical prospects, the management can see the advantages and the disadvantages as per the specification of the proposal. There are some of the methods that are beneficial for the company to take decision on the critical issue. Among them the major are the NPV, payback period and the ARR methods. The senior management should keep and check on both the issue while deciding the best among the project available for the company. The descriptions of the methods are given as under:

Net present value method: This method one of the important and prior method as the major objective of the method includes the life of the project. According to this method, the future value of the proposal is judged on the basis of present value of the proposal. The valuation of the money varies from time to time. As per as the analysis of the proposal is concern, if the valuation of the NPV is positive, then the company may proceed towards that and else if the figure that is valuated is negative the company should leave the proposal and should search for the new proposal. The major advantages of this method are as follows:

- The method is an inclusion of time value of money concept.

- The major objective is to determine the risk and profitability associated with the proposal.

- The cash flows are taken in to consideration while evaluating and analyzing.

- The valuation of the firm is also included.

Along with this there are some of the disadvantages. They are as follows:

- For the researcher it is difficult to implement it.

- Results that are determined through this method are not exact.

- The application depends on the life of the proposal.

Internal Rate of Return: It is one of the method through which it is possible to determine when the value of the PV will be zero. In other words it determines the exact point when the valuation of inflow is equal to outflow. The major advantages of this method are as follows:

- It includes the concept of time value of money.

- The flow that is inflow and the outflow are taken in to consideration.

- There is a calculation of rate of return.

- The choice for the proposal becomes specific and exact.

Along with this there are some of the disadvantages. They are as follows:

- It includes complication rated to the calculation of actual rate of the return.

- The economics of scale is ignored to some extent.

- The level of the complication increases with the nature of the cash flows.

- Least successful in many of the cases.

Payback period: The major role of this method is to determine the exact period when the proposal will be providing return to the investment. In this, the proposal with less payback period is determined as the best among the other alternatives. The major advantage of the method is as follows:

- The application of the payback period is very simple and convenient.

- The investment of the cash in liquid form is considered.

- The risk factor is also determined accordingly.

The disadvantages of this method are as follows:

- Time value money is ignored.

- The profitability factor associated with the proposal is ignored.

CONCLUSION

The research is helped to analyze the importance of the factors that are essential for the decision making process. The necessity of the financial statements for the efficient and effective decisions has been clear from this report. Therefore it is essential for the senior management level staff to be capable to analyze the advanced financial statistics. This research is helpful t related the importance of the financial analysis in the field of project management.

REFERENCES

- Khatta, R. S., 2008. Risk Management. Global India Publications.

- Aven, T. and Vinnem, E. J., 2007. Risk Management: With Applications from the Offshore Petroleum Industry. Springer.

- Chew, H. D., 2013. Corporate Risk Management. Columbia University Press.

- Shapira, Z., 2002. Organizational Decision Making. Cambridge University Press.

- Flynn, D.K., Uliana, E. and Wormald, M., 2012. Financial Managemnt-6th Edition, Juta and Company Limited.

- Stoltz, A., 2007. Financial Management, Pearson South Africa

- McMenamin, J., 2002. Financial Management: An Introduction. Routledge.

- Correia, C. and et.al., 2012. Financial Management. Juta and Company Ltd,.

- Foundations of business decision making: BUS 101 - Miami University., 2008. Thomson.

You May Also Like :

Sample About Working in Partnership